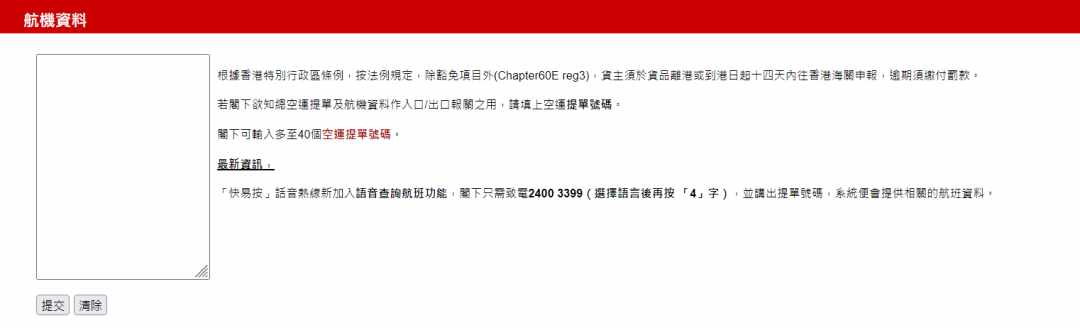

快递货物如何用单号查询航班?

1.各个快递查询航班网址(可以及时查看您的货物有没有安排航班)

输入快递单号即可

http://upsfd.ecfreight.net/

https://apps.dhl.com.hk/big5_fi/

https://wap-asia.fedex.com/hkodds/zh-hk/

2.问题

1.Disbursement Fee

垫付手续费,以联邦为例子的解释如下:

What is a disbursement fee?什么是垫付费?

FedEx may pay duties and taxes on your behalf. That means there’s a fee, also known as the disbursement fee, which is part of our ancillary charges.FedEx 可以代表您支付关税和税款。这意味着需要支付费用,也称为支付费用,这是我们辅助费用的一部分。

2.Merch. Proc. Fee商品加工费

What is Merchandise Processing Fee?

什么是商品加工费?

The

Merchandise Processing Fee (MPF) is a payment that needs to be made to

the US Customs and Border Protection (CBP) for imports into the US. MPF

is considered to be an ad valorem tax, meaning that it is a percentage

of the estimated value of the imported goods. This fee is levied for

imports made formally or informally. 商品加工费 (MPF) 是进口到美国需要向美国海关和边境保护局 (CBP) 支付的款项。MPF 被认为是一种从价税,这意味着它是进口商品估计价值的百分比。 该费用针对正式或非正式的进口商品征收。

The

value of MPF is based on the assessed value of the imported goods, and

it is calculated as proportionate to the estimated value of goods. MPF

can be considered to be a tax that is paid in addition to the duties

levied on any given shipment's entry summary.强积金的价值是根据进口货物的评估价值,按货物估计价值的比例计算。MPF 可以被认为是除了对任何给定货物的条目摘要征收的关税之外还要支付的税款。

How is Merchandise Processing Fee Calculated?

商品加工费如何计算?

The value of MPF is 0.3464% of the cargo value that was declared on the commercial invoice for imports. This fee is based on the value of the imported merchandise, excluding freight expenses, insurance charges, and duty. MPF 的价值是进口商业发票上申报的货物价值的 0.3464%。该费用基于进口商品的价值,不包括运费、保险费和关税

The MPF charge is fully covered by the importer of the goods. MPF for informal entries is assessed on goods transported to the US via air, ship, and international mail and is a fixed fee that ranges from US$2, US$6, and US$9 for every shipment.强积金费用由货物进口商全额承担。非正式入境的强积金是对通过空运、海运和国际邮件运往美国的货物征收的,每批货物收取 2 美元、6 美元和 9 美元的固定费用。

Formal entries are required for the import of goods valued at US$2,500 or higher. On the other hand, informal entries are for imports involving personal use or for commercial imports valued under US$2,500 (On the basis of importation requests made by the port director).进口价值 2,500 美元或以上的商品需要正式报关。另一方面,非正式条目用于涉及个人使用的进口或价值低于 2,500 美元的商业进口(根据港口主管提出的进口请求)。

我们建了一个亚马逊卖家交流群,里面不乏很多大卖家。

现在扫码回复“ 加群 ”,拉你进群。

热门文章

*30分钟更新一次