突发!社保缴费基数再上调!到手工资又要降!现在起正式执行!

The remarkable growth in filings for EU trade marks and designs by Chinese applicants may have come to prominence during 2020 – especially following the onset of the COVID 19 pandemic – but this story starts much earlier.

中方申请的欧盟商标及外观数量在2020年期间获得显著增长--其涨幅自COVID 19流行之后尤为明显--而在此之前其申请量就已经稳步增长。

The latest China Focus Report was initially compiled to look at the exponential growth in interest by Chinese applicants over the decade from 2010 to 2019, but the EUIPO felt that the picture would not be complete without bringing it up to date, and including the consequences during 2020 of this unprecedented upheaval.

最新的《中国焦点报告》最初是为了研究2010到2019年十年间中国申请人在欧盟申请的指数增长情况。而欧盟知识产权局认为该项研究需要及时更新才更完善,包括2020年这场史无前例的动荡所带来的影响。

However, the global COVID 19 pandemic is currently impacting and disrupting human societies, provoking health and economic crises in major economies and developing countries. Several of the ‘Top 10’ countries, in terms of EUTM and RCD filings, are amongst the hardest hit. Therefore, the EUIPO feels that the picture would not be complete without an update on the impact this unprecedented upheaval is having on the filings for EU IP rights.

然而,COVID 19疫情全球大流行正在影响和破坏人类社会,在主要经济体和发展中国家掀起一场健康和经济危机。欧盟商标和专利申请中排名前十的一些国家深受重创。因此,欧盟知识产权局认为有必要了解这场疫情的影响,对欧盟知识产权整体的分析才能更加全面准确。

This analysis focuses specifically on the preponderant influence of demand from China on overall application volumes for both EUTMs and Direct RCDs since the pandemic began to spread globally, that is, during the first few months of 2020. This general expansion can clearly be seen in the notable increase in the Chinese share of overall EUTM filings (from 9.5 % in 2019 to 16.2 % in 2020) and Direct RCD filings (from 14.3 % in 2019 to 19.1 % in 2020).

此分析聚焦自疫情全球蔓延之初,也就是2020年的前几个月,中国申请的需求量对欧盟商标及专利申请总量的影响。中国申请量在欧盟申请总量占比显著增长:欧盟商标申请量(自2019年9.5%的占比提升至2020年16.2%);欧盟专利申请量(自2019年的14.3%提升至2020年的19.1%)。

The predominance of technology-based enterprises, such as Huawei, in the Top 10 ranking of EUTM applicants from China is echoed in the distribution of the Top 10 Chinese EUTM classes filed for, with Class 9 (electrical apparatus; computers) accounting for 20 % of all Chinese EUTM class filings from 2010 to 2019.

欧盟申请人中排名前十的中国技术型企业,比如华为,在中国申请的欧盟商标排名前十的类别中占比优势显著。自2010年至2019年,9类(电气设备;计算机等)的申请量是中国申请的欧盟商标申请总量的20%。

The most relevant fluctuation in Chinese EUTM class filings for 2020 concerns Class 10 (medical apparatus & instruments). Indeed, more than 25 % of overall Class 10 filings in 2020 originated from Chinese applicants. This fact demonstrates a strong correlation between the increased global demand for personal protective equipment (PPE) and Chinese efforts to meet this demand by significantly increasing their production and supply of goods such as medical-grade gloves and masks.

2020年,在中国的欧盟商标申请中,10类(医疗器械相关)的申请量波动最大。实际上,超过25%的10类申请来自于中国申请人。这一事实也表明了,全球对个人防护设备(PPE)需求的增长与中国所做出的努力息息相关。中国为满足这一需求,大量增加了医疗物资(医用手套和口罩)的生产和供应。

2010-2019年的演变

The commercial appeal of the European Union (EU) common market is underscored by the exponential growth in the demand for EU Intellectual Property rights by Chinese applicants during the last decade.

在过去十年中,中国申请人对欧盟知识产权的需求呈指数增长,突显了欧盟市场的商业吸引力。

European Union Trade Mark (EUTM) application filings from China experienced remarkable growth from 2010 to 2019, with an average annual growth rate of 33.2% and an overall growth rate of 1,027.9% when comparing the 2019 and 2010 filing volumes. More than 63,000 EUTM filings, including over 116,500 goods and services classes, were filed by more than 47,000 individual applicants.

自2010至2019年,中国的欧盟商标申请量显著增长,2019年和2010年的申请量相比,年均增长率为33.2%,总体增长率为1,027.9%。超过47,000名个人申请人提交了63,000份欧盟商标申请,商品和服务的类别总量超过116,500个。

Direct Registered Community Design (RCD) filings from China also demonstrated a strong average annual growth rate of 31.4% during the last ten years and an overall growth rate of 890.4% when comparing the 2019 and 2010 filing volumes.

经统计,中国的欧盟外观设计申请在过去十年间涨势强劲,其平均年增长率达31.4%。2019年与2010年申请量相比,总体增长率为890.4%。

Almost 21,000 applications, with an average of 2.7 designs per application, were submitted to the European Union Intellectual Property Office (EUIPO) during this period, leading to nearly 57,000 individual design filings by over 11,000 individual applicants.

在此期间,欧盟知识产权局(EUIPO)收到申请大约21,000件,平均每份申请包含2.7件外观设计,超过11,000位个人申请人提交了近57,000件外观设计申请。

2020年COVID-19影响分析

The first months of the pandemic motivated sharp decreases in the overall demand for the EUIPO’s main products. Nevertheless, a robust recovery trend in filings, beginning in June 2020 and primarily driven by a highly substantial increase in Chinese demand, mitigated the initial negative COVID-19 impact and the EUIPO finished 2020 with a momentous overall EUTM filings growth of 10.2% vs. 2019. Additionally, the overall EUTM growth trend observed since the Summer of 2020 should continue in a moderately sustained fashion in 2021.

疫情爆发的前几个月,欧盟知识产权局收到的主流产品申请需求量急剧下降。尽管如此,自2020年6月起,欧盟申请大幅增长,缓解了COVID-19疫情最初带来的负面影响。欧盟知识产权局在2020年底也达成了欧盟商标申请10.2%的增长。此外,从2020年夏季欧盟商标增长趋势来看,预估2021年也将保持稳步增长。

The considerable increase in Chinese EUTM filings (+88.8% in 2020 vs. 2019) has been the main driving force behind the overall recovery trend, given that many Top 10 filing countries such as the United States have either stagnated or decreased their demand since the beginning of the pandemic.

对比在疫情之初许多申请量排名前十的国家,比如美国,需求量停滞不前或者有所下降的情况,中国的欧盟商标申请量大幅增长(2020年与2019年相比增长了88.8%),成为了总体复苏的主要驱动力。

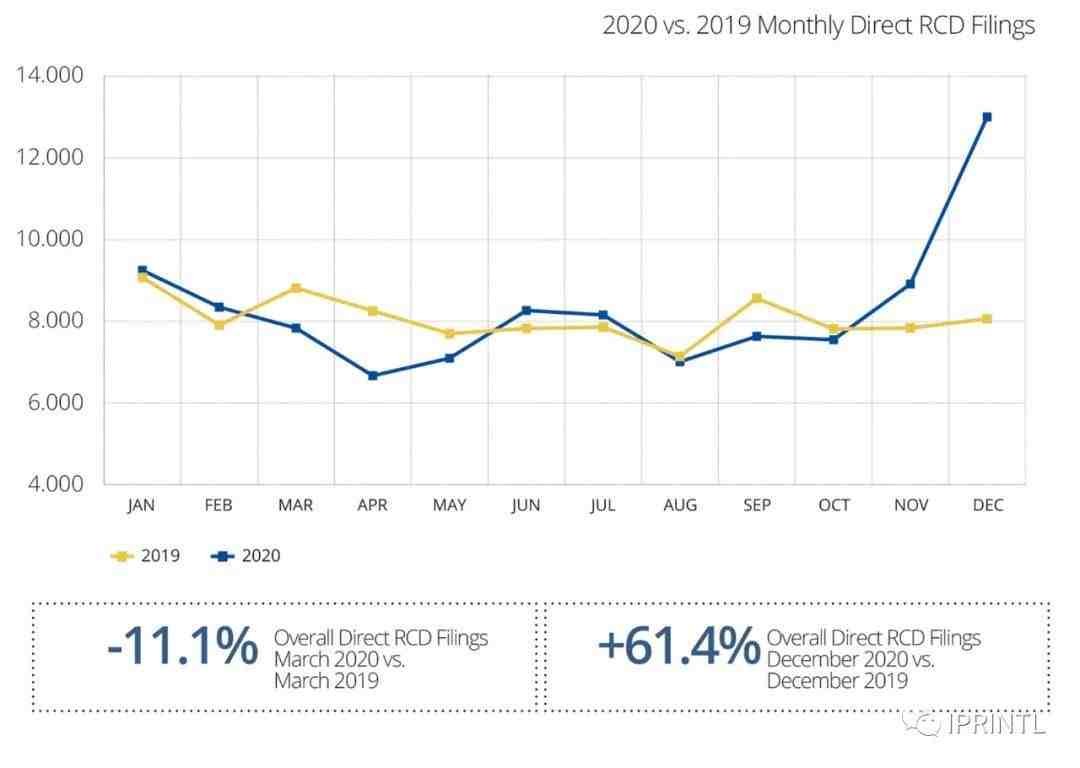

The impact of COVID-19 on the overall demand for Direct RCDs is presented in the next chart. A comparison of the monthly Direct RCD filing volumes in 2020 vs. 2019 reveals significant negative variations during the Spring (March-May), followed by positive variations during the beginning of Summer (June-July), in a similar pattern to the observed behaviour of EUTM filings. However, unlike EUTMs, the recovery and growth trend for Direct RCD filings stalled in August and monthly volumes remained lower than in 2019 until October. Nevertheless, a significant surge in filings during November and December, largely fuelled by Chinese applications, resulted in an overall annual growth rate of 2.8% for 2020 vs. 2019.

下图显示了COVID-19疫情对欧盟外观专利申请总体需求的影响。通过比较2019年和2020年每月欧盟外观专利申请量,可以看到春季(3月至5月)显著的负增长,以及夏季初(6月至7月)出现的正增长。这与欧盟商标的申请量涨势相似。然而,与欧盟商标不同的是,欧盟外观专利申请增势在8月份停滞不前,每月交易量仍低于2019年同期,这样的情况一直保持到10月份。尽管如此,在11月和12月期间,中国的外观申请量仍大幅增加,从而大大推动了整体的增长,2020年与2019年的整体年增长率达到2.8%。

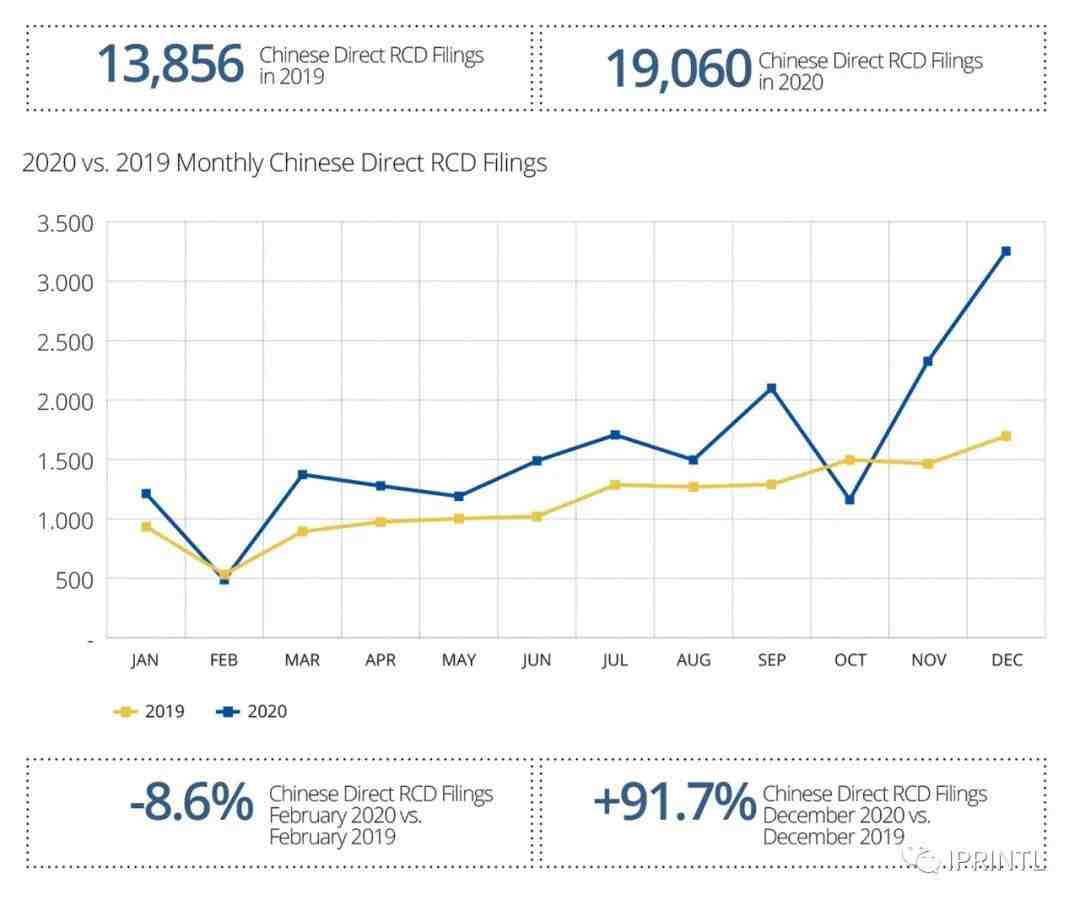

The evolution of the sizable annual increase in Chinese Direct RCD filings (+37.6% in 2020 vs. 2019) is clearly visible when comparing the monthly filings volumes from the two years under consideration. With the exception of February (-8.6%) and October (-22.4%), monthly Direct RCD filing inflows from China were consistently and significantly higher in 2020 vs. 2019, particularly during the final months of the year (+58.9% in November and +91.7% in December).

比较2020年和2019年两年的每月申请量,中国的欧盟专利申请量的增长相当显著(2020年与2019年相比增长37.6%)。除了2月份(-8.6%)和10月份(-22.4%),中国的欧盟外观申请量有所减少之外,其他月份与往年同期相比显著增长,尤其是最后两个月(11月份增长58.9%,12月份增长91.7%)。

总结

The COVID-19 pandemic clearly influenced the overall demand for EUTMs and RCDs during 2020, at first provoking sharp decreases in filings for both EU IP rights. However, an extremely strong recovery dynamic in EUTM filings, primarily driven by significant increases in Chinese demand, has sustained overall EUTM growth since June 2020.

COVID-19大流行一开始就导致欧盟IP申请量急剧下降,对2020年一整年的欧盟商标和外观申请量的影响显而易见。然而,自2020年6月以来,中国需求量的大幅增长带动欧盟申请量呈现出极其强劲的复苏态势,推动欧盟商标申请持续增长。

Although the progress in the recovery of overall Direct RCD filing volumes has been less linear than that observed for EUTMs, China decisively contributed to mitigating the negative impact of the pandemic on the overall demand for this right by substantially increasing its filings during 2020.

尽管欧盟外观总量恢复情况不如欧盟商标,中国在2020年期间的增量为缓解疫情带来外观申请总量的消极影响做出了决定性贡献。

The pandemic did not produce major changes regarding the basic composition and share distribution of the Top 10 overall EUTM and Direct RCD filing classes in 2020, although certain variations were most likely driven by COVID-19.

尽管COVID-19疫情导致某些特定类别的申请量变化,但并未对2020年排名前10的欧盟商标申请和欧盟外观申请总量类别的基本构成和份额分配产生重大变化。

However, some substantial shifts in the 2020 Chinese Top 10 filing classes rankings for both EU IP rights provide insight into China’s efforts to adjust its industrial outputs in order to meet the changing needs of global consumers and health authorities during the pandemic. This is clearly visible in the general upsurge in class filings for medical, personal and public hygiene, entertainment and household-related goods and products.

然而,2020年中国的欧盟知识产权十大申请类别排名中有一些重大变化,也使我们了解到中国调整了工业产出,为满足全球消费者和卫生当局在大流行期间不断变化的需求做出了许多努力。中国在医疗,个人和公共卫生,娱乐以及与家庭有关的商品和产品的申请量高涨,就可以清楚地看出这一点。

China's preponderance on EUTM and Direct RCD filings during 2020 is quite evident and was clearly decisive in sustaining the overall growth dynamic for the EUIPO’s main products under extremely difficult circumstances. The Office will closely monitor the evolution of filing volumes from China and other countries in order to properly adjust strategies and capabilities aimed at continuing to meet the needs of its users with excellent quality and timeliness.

综上,2020年期间,在如此极端困难的情况下,中国在欧盟商标和外观申请上优势明显,在维持欧盟知识产权局主要产品整体增长趋势上具有决定性作用。欧盟官方也将密切关注中国和其他国家申请量的变化,并适当调整战略,给用户提供优质和及时的服务。

本文数据来源:

https://euipo.europa.eu/ohimportal/news/-/action/view/8545844

来源:IPRINTL

作者:WPIP-Vera

编辑:IPRINTL-Elaine

校对:IPRINTL-Jane

我们建了一个亚马逊卖家交流群,里面不乏很多大卖家。

现在扫码回复“ 加群 ”,拉你进群。

热门文章

*30分钟更新一次