FBA预包装,你知道与不知道的亚马逊FBA仓库规则都在这里了!

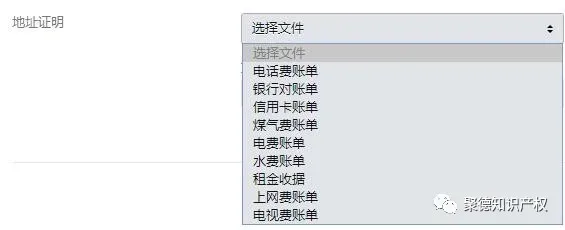

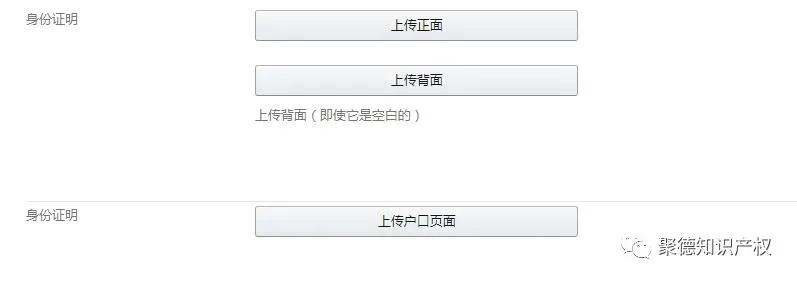

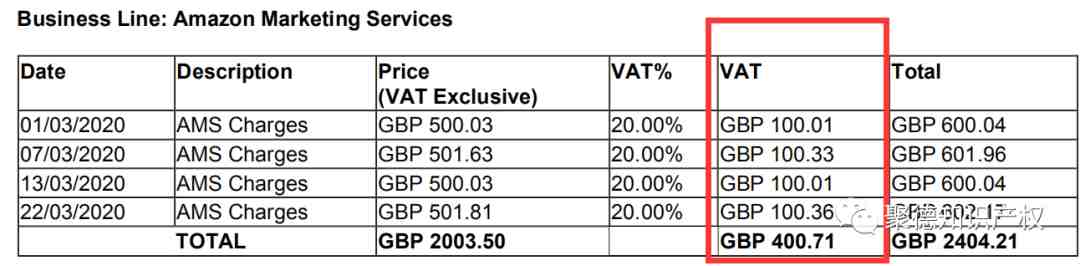

“海外卖家虽持有英国VAT,但公司非英国/欧盟公司,亚马逊不应该向海外卖家收取服务类费用的VAT。所以此类发票无法抵扣。如果您有这种含税发票,需要您联系亚马逊那边,亚马逊需要把增值税金额退还给您。” 第一步:准备资料

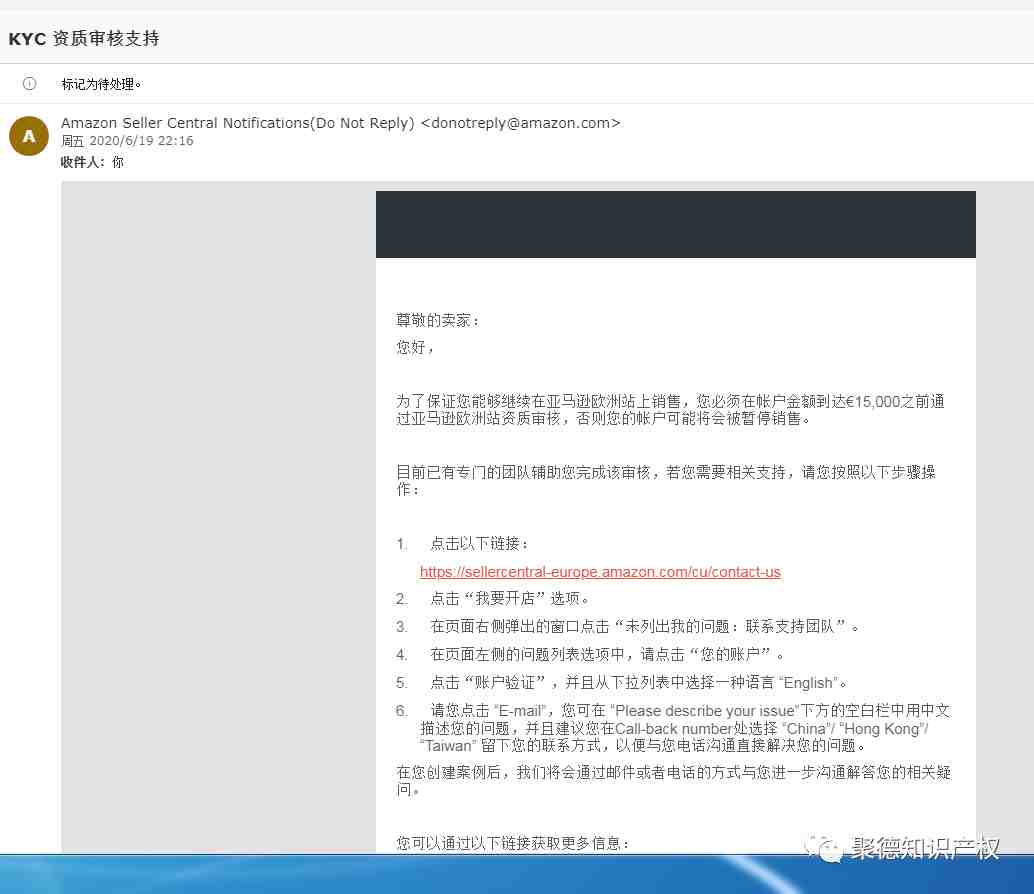

第二步:开英文case Case里能提供的文件数量只有6个,所以需要把这几十张发票用PDF编辑器合并成一个PDF文件。 VAT ID number:GB444444444 From October 7, 2018 to March 1, 2020, we were not only charged for advertising fees, but also charged an additional 20% VAT. But this VAT cannot be deducted. And we have learned that the UK Revenue Agency has made it clear that although overseas sellers hold UK VATs, companies that are not UK / EU companies should not charge VATs for service fees from overseas sellers. Here are the invoice and fees we have calculated for advertising VAT, totaling £ 4444.44,These fees should be refunded to us. Please investigate: If you need other information, please reply to us, we will try our best to cooperate with you and provide corresponding information. Thank you very much for your help (We are not good at English, please reply to the email, thank you). (附件添加发票) 第三步、催促 Hello, It's been a long time since we last submitted relevant information. In 2020 March, we were charged again£444.44, so the current total fee is £ 4444.44, the following attachments are March 2020 invoice and the previous Collection invoices Now The total VAT for advertising that needs to be refunded is £ 4444.44, because we are not an EU / UK entity, and Amazon should not charge VAT for advertising, so these fees should be refunded. Our Business VAT number: GB444444444 Moreover, due to the recent global special situation, and these fees will increase every month, which has a great impact on our company's capital chain, we urgently need this refunded fee To ease our plight. Can you give an approximate time to solve this issue? Thank you very much for your help. 2020-04-04 (附件附上之前的发票和新的发票) 第四步、打太极 -FINSH- 以上为知无不言卖家分享的帖子,无删改。

我们建了一个亚马逊卖家交流群,里面不乏很多大卖家。

现在扫码回复“ 加群 ”,拉你进群。

热门文章

*30分钟更新一次